Introduction

In B2B, “good marketing” is not the same as “safe communication.” When jade is sold with metaphysical claims—“energy,” “healing,” “luck”—the narrative might sound persuasive, but it typically collapses the moment a buyer needs to defend the purchase internally, handle customer disputes, or align with platform policy. A serious buyer is not looking for a spiritual explanation. They are looking for a supplier who can explain what the material is, what was done to it, what cannot be guaranteed, and what can be verified.

This guide is written for product managers, designers, and procurement owners who want to source jade products with confidence. It rejects pseudoscience for one reason: not because it is “uncool,” but because it creates unclear promises—and unclear promises become disputes. We’ll translate “jade processing” into practical buyer language: process selection, yield reality, treatment disclosure, and testing strategy that reduces conflict without pretending perfection is possible.

Table of Contents

Mystical Claims Create Commercial Risk—Not Value

Why procurement teams distrust “energy jade” positioning

If your buyer is a real business, they live inside accountability systems. That means contracts, platform rules, quality claims, warranty terms, and customer expectations must all match what is deliverable. Mystical storytelling avoids specifics, and that is exactly why it creates risk. It is hard to defend internally and impossible to operationalize on a spec sheet.

A supplier earns trust in B2B by being consistent in language and process. When claims cannot be measured or verified, they cannot be managed. The result is not “brand magic.” The result is chargebacks, returns, and endless argument about what was “promised.”

What serious buyers want instead

Serious buyers want the opposite of metaphysical claims. They want clear answers to boring questions: What material is it? What processing steps were used? What counts as treatment? What can vary piece-to-piece? What is the escalation path if uncertainty exists? These are not “less inspiring” questions. They are the questions that keep supply chains stable.

A professional supplier also avoids absolute language that expands liability beyond reality. If a seller says “guaranteed untreated,” buyers assume the seller has proven it universally, which is often technically indefensible. The safer approach is: define scope, disclose what is known, state what was tested, and state what remains uncertain.

The buyer takeaway

If you want fewer disputes, you do not need “better stories.” You need a supplier who uses defensible documentation. In jade processing, what is documented is defendable. What is assumed is not.

Natural ≠ Untreated: Definitions That Prevent Expensive Misunderstandings

“Natural” describes origin, not the absence of processing

A natural stone can be natural and still be cut, carved, and polished. Processing that changes only shape and surface finish does not automatically make the stone “treated.” Confusion starts when marketing uses “natural” as a blanket claim and buyers interpret it as “untreated.”(GIA Jade Overview)

For B2B buyers, you should insist on two separate fields in every spec sheet: (1) material origin classification and (2) treatment status. When these are separated, disputes drop because the contract language matches technical reality.

What “treated stone” means in trade terms

A stone can be of natural geological origin and still be treated. In professional trade, a stone is classified as treated when human intervention alters internal structure, chemistry, color stability, or long-term behavior. That is the definition that matters for compliance and trust.

This is why “minor treatment” is not a safe concept. If it alters the material state, it qualifies as treatment regardless of degree, and disclosure is required. The central B2B conflict is rarely “should treatment exist.” It is whether treatment status is clearly disclosed, because undisclosed treatment is a major risk scenario in trade.

Treated vs synthetic vs imitation: don’t let words hide classification

Buyers often use “fake” as a catch-all term, but that destroys clarity. Treated stones can still be natural in geological origin, while synthetic stones are artificially created and imitation materials are different substances entirely. All require disclosure, but the commercial and compliance implications differ.

If your supplier can’t hold these definitions steady in writing, that’s a red flag. Definitions are not “marketing.” They are the infrastructure that protects your brand from misrepresentation claims.

Proof Is a Process: Disclosure Before Conclusions

A professional workflow starts with clarity, not confidence

One of the biggest sourcing mistakes is choosing a supplier who speaks with high confidence but low structure. In stones, certainty is often a performance. What reduces disputes is not confidence. It is a workflow that separates facts from interpretation and documents uncertainty properly.

A defensible approach is “disclosure before conclusion.” That means definitions first, then risk screening, then escalation options like laboratory testing or third-party verification, followed by consistent disclosure language. It also means your supplier should be comfortable saying what remains untested.

Documentation is a risk-control tool

In B2B, documentation is not paperwork. It is liability control. A supplier should record observed indicators, document uncertainty and actions taken, and keep disclosure language consistent across sales and QC. That consistency is what prevents “someone said X” disputes later.

When teams resist escalation, it’s often because they fear appearing uncertain or slowing down timelines. But unmanaged certainty creates larger conflicts later. If your supplier treats uncertainty as shameful, they will hide it until it becomes expensive.

Buyer takeaway: ask for the escalation path

Your RFQ should request the supplier’s escalation options and decision rules. If the answer is “we just know,” you’re paying for a future dispute. If the answer includes structured screening, testing selection logic, and documented disclosure, you’re paying for stability.

Jade Processing Is a Probability Game: Structure, Orientation, Yield

Why “just rotate it” is not a real solution

Natural stone has directional structural behavior. Strength and fracture resistance can change dramatically depending on cutting orientation relative to internal structure, and internal grain is not fully visible from surface clues. That means optimal orientation is often discovered, not guaranteed.

This is why buyer instructions like “cut it the safer way” often fail. Rotating may solve one weakness and expose another, and the best orientation for strength can conflict with appearance goals. A supplier who explains this early is not “making excuses.” They are protecting the project.

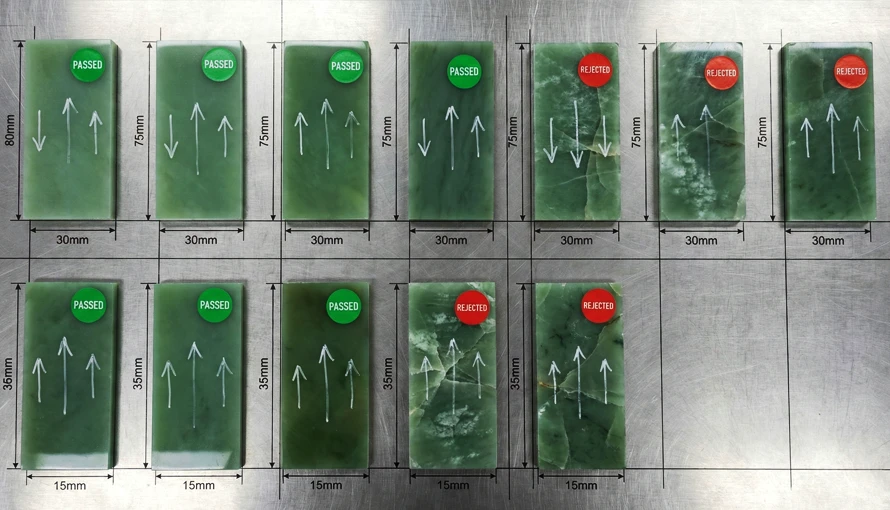

Yield explains pricing, lead time, and why similar products vary in cost

Yield is the percentage of input rough that successfully becomes sellable output. In stone, yield is inherently variable and should be calculated across batches, not promised per piece. If 10 rough pieces are processed and 6 become sellable, the yield is 60%.

The critical buyer insight is: yield behaves like a probability distribution, not a guarantee. It is influenced by structure variability, hidden fractures, design complexity and thickness, orientation, and processing strategy. Lower yield increases effective cost per successful unit, even if the factory is efficient.

Risk management is professional; risk denial is not

Professional jade processing manages risk through conservative toolpaths and staged removal, frequent inspection checkpoints, and switching to manual control when anomalies appear. The goal is not to pretend risk never existed, but to detect failure early and limit loss magnitude.

This is also why buyers sometimes misunderstand good factories. Successful risk mitigation leaves no visible trace, so buyers assume risk was never present. A good supplier communicates risk categories upfront, defines acceptable loss rates, and separates material risk from workmanship responsibility.

CNC vs Hand Carving: Choosing the Process Without Hype

CNC carving: repeatability with lower tolerance for hidden defects

CNC carving prioritizes dimensional accuracy and repeatability. It relies on digital toolpaths and fixed parameters, scales well for standardized designs, and holds tighter tolerances.

The trade-off is that CNC has limited real-time adaptation to material variation. Hidden internal cracks can be exposed abruptly, heterogeneous material can break more easily, and parameter mismatch can amplify defects. The failure mode is often binary: pass/fail.

Hand carving: adaptive response with lower absolute precision

Hand carving prioritizes continuous feedback. A skilled craftsperson can adjust depth, pressure, and path in real time as resistance changes, which can reduce catastrophic breakage on variable stone.

The trade-off is that hand carving is slower and skill-dependent. Absolute precision and batch consistency are limited by human variation, and labor dependency is higher. For many B2B programs, that means you can buy risk reduction, but you cannot buy “machine-level sameness.”

The professional default: hybrid workflows

In real factories, the best answer is often “hybrid.” Hybrid processes combine CNC roughing with manual finishing, with iterative inspection and adjustment between stages. Each handoff point becomes a risk checkpoint, and this can reduce catastrophic breakage while preserving efficiency.

The logic is simple: automate what is predictable and have humans handle what is not. That framing is more useful than “machine-made vs hand-made,” because it links the process choice to risk management rather than aesthetics.

Buyer rule of thumb (easy to apply in RFQs)

If the design requires tight tolerance and high repeatability, CNC is a strong fit. If material variability or defect risk is high, hand carving or hybrid strategies are usually safer. This is not a “preference.” It is risk allocation.

.webp)

Toolpath and Parameters Matter More Than Machine Brand

Why identical CNC machines can produce different outcomes

Buyers often compare suppliers by machine brand and assume outcomes are hardware-driven. In stone processing, outcome is often determined more by strategy than hardware. Toolpath direction can control stress accumulation and crack propagation, and feed rate and spindle speed must match material structure.

Aggressive parameters increase speed but amplify hidden defects. Conservative strategies trade speed for yield stability, which is usually what B2B buyers actually want—stable delivery and predictable scrap behavior.

Toolpath is stress management

Toolpath is not just geometry. It defines cutting direction, entry and exit points, depth progression, and load distribution over time. Smooth continuous paths reduce shock loading, while sudden directional changes concentrate stress. Deep single-pass cuts increase fracture probability.

The practical implication is that “same 3D file” does not guarantee “same result.” Natural stone does not behave like metal or plastic, and CNC follows the design regardless of material feedback. Hand carving can adjust in real time, which is why outcomes diverge even when designs match.

What buyers should ask for

Ask your supplier how they select conservative vs aggressive strategies, and where inspection checkpoints occur. You are not asking them to reveal trade secrets. You are asking whether they understand that yield stability is a manufacturing decision, not luck.

Treatments Exist. Non-Disclosure Is the Problem.

Polymer impregnation (resin filling): what it is and why it’s used

Polymer impregnation is a treatment where pores, fissures, or fractures are filled with resin/polymer under pressure or vacuum. It doesn’t create the stone, but it modifies internal voids to improve apparent integrity and polish response.

It is used to stabilize fragile material, reduce visible cracking, improve polish and marketability, and increase yield from low-grade rough. The driver is economic pressure, not geological enhancement. That reality is exactly why disclosure matters.

Long-term performance risks buyers must understand

Resin can age, yellow, cloud, or behave unpredictably under heat, UV, or solvents. It can also reduce re-polishing or repair tolerance. These risks do not automatically mean “bad product,” but they absolutely mean the product must be positioned and warranted correctly.

A professional supplier should avoid definitive “it is filled” claims without testing, but should clearly communicate elevated risk signals and offer escalation options. The goal is not to accuse. The goal is to prevent mismatched expectations and future disputes.

Heat treatment: not dyeing, still disclosure-relevant

Heat treatment alters appearance through controlled thermal exposure. No foreign material is added, but internal state and stability may change, and disclosure is still required in professional B2B trade.

This matters because buyers often assume “no additives” means “no disclosure.” That assumption is unsafe. From a compliance and trust perspective, treatment status should remain contract-level information.

Testing Strategy: Evidence Without False Certainty

Choose tests based on what you need to know

Testing is often misunderstood as a way to “prove everything.” A better rule is: choose tests based on what you need to know, not what sounds authoritative. Testing should narrow uncertainty, support honest disclosure, and demonstrate due diligence. It should not be used as a marketing guarantee.

Over-testing can backfire because it increases buyer expectations of certainty, encourages report cherry-picking, and expands liability beyond test scope. More testing does not automatically mean less risk. Better-aligned testing usually means fewer disputes.

FTIR example: powerful tool, limited scope

FTIR detects molecular vibration signatures, not geological origin. It is highly effective at identifying polymers and resins, which is why it is often used to screen for polymer impregnation or organic coatings.

But “no polymer detected” does not prove “untreated.” FTIR is a filter, not a verdict, and overreliance creates false certainty in trade decisions. If your supplier uses a single test report as a universal claim, that’s a warning sign.

How to communicate test results professionally

A defensible statement includes: what was tested, what was detected, what remains untested or uncertain, and language aligned with disclosure standards. It explicitly avoids absolute claims like “fully certified” or “guaranteed untreated.” This is the communication style that protects both buyer and supplier.

A Practical Supplier Evaluation Checklist for Jade Processing (RFP-Ready)

Documents to request (minimum viable transparency)

Ask for written disclosure standards, a QC checkpoint overview, a process selection recommendation (CNC vs hand vs hybrid), and a testing escalation policy. You are not asking for their secrets; you are asking for whether the supplier can operate in a defensible B2B environment.

Also request sample language used on invoices or specification sheets. A supplier who cannot keep language consistent across teams is likely to create contradictions later. Consistency is not bureaucracy. It is dispute prevention.

Questions that expose risk early

Ask how they handle yield variability, what they consider “acceptable loss rates,” and how they separate material risk from workmanship responsibility. Ask what happens when late-stage breakage occurs and whether salvage/redesign is part of their mitigation strategy. A supplier who answers calmly and structurally is usually safer than one who answers emotionally.

Ask how they treat “same design, different outcome” situations. If they claim “same file = same result,” they either don’t understand stone or they are overselling. Natural stone does not behave like metal or plastic, and process logic matters.

Minimum communication standard

Your supplier should define “natural,” clarify whether you mean treated or untreated, and avoid yes/no answers without disclosure context. That is not evasiveness. That is professionalism.

Conclusion

Rejecting pseudoscience is not a branding choice. It is a commercial discipline. In jade processing, credibility is built with definitions, risk-aligned process selection, yield realism, and documentation that stays consistent from quote to delivery.

If you want a sourcing relationship that scales, choose a supplier who can explain trade-offs clearly: CNC vs hand vs hybrid, conservative vs aggressive strategy, and disclosure language that does not pretend certainty where none exists. That supplier will usually cost less in the only metric that matters long-term: disputes, rework, and reputation damage.

FAQ

Is polished jade still natural?

Polishing changes surface finish and does not automatically change geological origin. The key is not whether it was polished, but whether anything altered internal structure, chemistry, or long-term behavior. That is why “natural” and “untreated” must be separated in documentation.

Does treated mean fake?

No, treated stones can still be of natural geological origin. The B2B risk is not treatment itself; it is non-disclosure, because treatment status is contract-level information. Your decision should be driven by performance expectations and disclosure clarity, not moral judgment.

Can you guarantee identical pieces across a batch?

In natural stone, absolute sameness is not realistic because internal structure variability and orientation effects constrain consistency. Professional factories manage risk through checkpoints and process strategy, but risk cannot be eliminated. If someone promises perfect sameness, ask how they control variability without changing material classification.

Can you tell if resin filling exists by looking?

Visual screening can flag elevated risk, but definitive claims should not be made without testing. A defensible supplier explains indicators, then offers escalation options like testing or enhanced disclosure with limitation notes.

-900x375.webp)